AROUND NEW HAMPSHIRE

1. Odds & Ends

Income tax talk making comeback

State House Dome, by Garry Rayno, unionleader.com, September 26, 2015

LAWMAKERS USED to have annual battles over income tax talk, but up until recently such talk never went very far.

That is about to change.

Rep. Paul Henle, D-Concord, wants lawmakers to have a serious discussion about the state's tax structure and how New Hampshire raises revenue.

“New Hampshire is stuck, stuck in the mud, and we've got to find some way out of it,” Henle said last week. “We've got to call the tow truck.”

Unlike past income tax proposals, Henle wants to separate revenues from spending. Rather than raise more money to fund programs, Henle would use the $1.13 billon raised annually by way of a 3.75 percent income tax. The plan would eliminate the statewide property and utility property taxes, the interest and dividends tax, and the business enterprise tax, while substantially reducing the business profits tax, he said.

“I'm trying to find a center here on an issue that has never had a center before,” he said, noting he has not talked to anyone who does not want to reduce business or property taxes.

Henle has dubbed his proposal the NH Tax Shift Plan and said he plans to meet with business organizations and other groups to gauge support.

Under his plan, the BPT would decrease from 8.5 to 3.75 percent. “This would give businesses in New Hampshire $440 million to use to hire workers and raise wages,” said Henle, the former executive director of the Granite State Fair Tax Coalition. “It would also help attract new businesses to the state.”

Under the plan, $50 million would be used to restore revenue sharing with cities and towns, $56 million would go into the rainy day fund, and $40 million for the general fund.

Revenue sharing and eliminating the statewide property tax and utility property tax would help lower property taxes, Henle said.

“We can all agree that property taxes are too high in New Hampshire,” said Henle. “Every year property taxes go up, every year the state downshifts more costs onto the local cities and towns. The NH Tax Shift Plan takes a good first step toward reversing that trend.”

The income tax would apply to a person's federally adjusted gross income with the same standard deductions as under the federal income tax. There would be no itemized deductions under his plan.

“I see it as an economic stimulus,” Henle said, “I'm not so wet behind the ears that I do not see a problem introducing an income tax, but so be it.”

In the 1970s, 80s and 90s, not having an income tax was part of what was called the “New Hampshire Advantage,” he said, but that is gone now, noting the Granite State didn't lead the region out of the last recession.

“This is a way for New Hampshire to move forward,” Henle said. “If we continue raising money the way we are (currently) raising money, we are just going to raise less and less every year.”

For years lawmakers debated income tax proposals, particularly during the early 1990s and after the Supreme Court's Claremont education decision.

In 1999, the House and Senate both passed an income tax bill, although they were different versions, and the two bodies never agreed on one plan in the face of then-Gov. Jeanne Shaheen's vow to veto any plan that reached her desk.

Since that time there has not been a significant push to overhaul the state's tax structure with an income tax.

Henle says he believes now is a good time to at least begin the debate.

“We need to do something about raising money in a better fashion,” Henle said.

Thanks again

Sens. Lou D'Allesandro, D-Manchester, and Nancy Stiles, R-Hampton, several years ago sponsored to authorize the University of Madaba as an affiliate institution of higher education under the NH Higher Education Commission.

The two traveled to Amman, Jordan, several years ago when the new university opened and returned earlier this month for the institution's first graduation ceremony.

D'Allesandro delivered the commencement address to the university's first graduating class.

Currently, the school has 1,700 students from 31 countries.

“It was wonderful to see so many young people seizing the opportunity to enhance not only their own lives by obtaining a quality higher education but to also embrace the university's mission to foster a brighter, more peaceful future for their region,” said D'Allesandro after his return. “Education truly is the key to their future.”

Merrimack County court

For years lawmakers, state court officials and the Concord legal community have tried to determine where a new county courthouse should be built.

No one disagrees the current facility on North Main Street is inadequate. It is out-dated, lacks sufficient space for courtrooms, the clerk's office and parking.

The legal community pushed for years to keep the facility in downtown Concord convenient to their nearby law offices.

However, finding an area large enough to build such a facility downtown has been problematic if not nearly impossible.

So this year the capital budget included money to build a new Merrimack County courthouse, but designated it be built on state land near the state Supreme Court building.

Although it was no secret where lawmakers wanted the new building to be, Merrimack County officials are not happy with the change, as its offices share space with the courts in the North Main Street complex.

County officials asked Rep. Dan McGuire, R-Epping, to propose an amendment when lawmakers were voting on vetoes two weeks ago that would change the location of the new court.

The amendment went nowhere for several reasons, including the fact that House members did not want to change Senate Bill 9, which was the compromise budget plan that would have to go back to the Senate if changes are made.

But that is not the end of the story.

The Senate Capital Budget Committee holds an informational meeting Oct. 6 to discuss the courthouse and its location.

The Merrimack County court facility is one of the last to be updated in the state and many lawmakers are losing their patience.

However as the late great Yankee sage used to say “It ain't over till it's over.”

Retiring

Don Shumway spent many years in state government, as Department of Health and Human Services Commissioner and as head of the division of mental health and developmental services, serving as one of the architects of closing the Laconia State School and moving mental health treatment into the communities, while drastically reducing the population of New Hampshire State Hospital.

For the past 13 years Shumway has served as Crotched Mountain Foundation president and CEO, but Friday the board of directors announced he will retire once a replacement is found.

“After decades of focusing on all families, it is long overdue that I focus on being present in the lives of those I love,” he said.

Shumway told the foundation's 900 employees of his plans Friday.

On hold

There has been much speculation around the State House when Gov. Maggie Hassan makes her announcement about her future plans.

If the announcement comes before the end of the month, it may signal she is staying put, but if it is Oct. 1 or thereafter it may mean a run for the U.S. Senate is in her future.

The key is the end of the fundraising quarter for federal office, which is Sept. 30.

Potential donors like to look at how well a candidate's fundraising does in the first quarter after he or she announces a run.

Announcing for a federal office between now and the end of the month would make it difficult to present a rosy financial picture to potential donors.

Everyone is waiting for the governor's decision.

That is about to change.

Rep. Paul Henle, D-Concord, wants lawmakers to have a serious discussion about the state's tax structure and how New Hampshire raises revenue.

“New Hampshire is stuck, stuck in the mud, and we've got to find some way out of it,” Henle said last week. “We've got to call the tow truck.”

Unlike past income tax proposals, Henle wants to separate revenues from spending. Rather than raise more money to fund programs, Henle would use the $1.13 billon raised annually by way of a 3.75 percent income tax. The plan would eliminate the statewide property and utility property taxes, the interest and dividends tax, and the business enterprise tax, while substantially reducing the business profits tax, he said.

“I'm trying to find a center here on an issue that has never had a center before,” he said, noting he has not talked to anyone who does not want to reduce business or property taxes.

Henle has dubbed his proposal the NH Tax Shift Plan and said he plans to meet with business organizations and other groups to gauge support.

Under his plan, the BPT would decrease from 8.5 to 3.75 percent. “This would give businesses in New Hampshire $440 million to use to hire workers and raise wages,” said Henle, the former executive director of the Granite State Fair Tax Coalition. “It would also help attract new businesses to the state.”

Under the plan, $50 million would be used to restore revenue sharing with cities and towns, $56 million would go into the rainy day fund, and $40 million for the general fund.

Revenue sharing and eliminating the statewide property tax and utility property tax would help lower property taxes, Henle said.

“We can all agree that property taxes are too high in New Hampshire,” said Henle. “Every year property taxes go up, every year the state downshifts more costs onto the local cities and towns. The NH Tax Shift Plan takes a good first step toward reversing that trend.”

The income tax would apply to a person's federally adjusted gross income with the same standard deductions as under the federal income tax. There would be no itemized deductions under his plan.

“I see it as an economic stimulus,” Henle said, “I'm not so wet behind the ears that I do not see a problem introducing an income tax, but so be it.”

In the 1970s, 80s and 90s, not having an income tax was part of what was called the “New Hampshire Advantage,” he said, but that is gone now, noting the Granite State didn't lead the region out of the last recession.

“This is a way for New Hampshire to move forward,” Henle said. “If we continue raising money the way we are (currently) raising money, we are just going to raise less and less every year.”

For years lawmakers debated income tax proposals, particularly during the early 1990s and after the Supreme Court's Claremont education decision.

In 1999, the House and Senate both passed an income tax bill, although they were different versions, and the two bodies never agreed on one plan in the face of then-Gov. Jeanne Shaheen's vow to veto any plan that reached her desk.

Since that time there has not been a significant push to overhaul the state's tax structure with an income tax.

Henle says he believes now is a good time to at least begin the debate.

“We need to do something about raising money in a better fashion,” Henle said.

Thanks again

Sens. Lou D'Allesandro, D-Manchester, and Nancy Stiles, R-Hampton, several years ago sponsored to authorize the University of Madaba as an affiliate institution of higher education under the NH Higher Education Commission.

The two traveled to Amman, Jordan, several years ago when the new university opened and returned earlier this month for the institution's first graduation ceremony.

D'Allesandro delivered the commencement address to the university's first graduating class.

Currently, the school has 1,700 students from 31 countries.

“It was wonderful to see so many young people seizing the opportunity to enhance not only their own lives by obtaining a quality higher education but to also embrace the university's mission to foster a brighter, more peaceful future for their region,” said D'Allesandro after his return. “Education truly is the key to their future.”

Merrimack County court

For years lawmakers, state court officials and the Concord legal community have tried to determine where a new county courthouse should be built.

No one disagrees the current facility on North Main Street is inadequate. It is out-dated, lacks sufficient space for courtrooms, the clerk's office and parking.

The legal community pushed for years to keep the facility in downtown Concord convenient to their nearby law offices.

However, finding an area large enough to build such a facility downtown has been problematic if not nearly impossible.

So this year the capital budget included money to build a new Merrimack County courthouse, but designated it be built on state land near the state Supreme Court building.

Although it was no secret where lawmakers wanted the new building to be, Merrimack County officials are not happy with the change, as its offices share space with the courts in the North Main Street complex.

County officials asked Rep. Dan McGuire, R-Epping, to propose an amendment when lawmakers were voting on vetoes two weeks ago that would change the location of the new court.

The amendment went nowhere for several reasons, including the fact that House members did not want to change Senate Bill 9, which was the compromise budget plan that would have to go back to the Senate if changes are made.

But that is not the end of the story.

The Senate Capital Budget Committee holds an informational meeting Oct. 6 to discuss the courthouse and its location.

The Merrimack County court facility is one of the last to be updated in the state and many lawmakers are losing their patience.

However as the late great Yankee sage used to say “It ain't over till it's over.”

Retiring

Don Shumway spent many years in state government, as Department of Health and Human Services Commissioner and as head of the division of mental health and developmental services, serving as one of the architects of closing the Laconia State School and moving mental health treatment into the communities, while drastically reducing the population of New Hampshire State Hospital.

For the past 13 years Shumway has served as Crotched Mountain Foundation president and CEO, but Friday the board of directors announced he will retire once a replacement is found.

“After decades of focusing on all families, it is long overdue that I focus on being present in the lives of those I love,” he said.

Shumway told the foundation's 900 employees of his plans Friday.

On hold

There has been much speculation around the State House when Gov. Maggie Hassan makes her announcement about her future plans.

If the announcement comes before the end of the month, it may signal she is staying put, but if it is Oct. 1 or thereafter it may mean a run for the U.S. Senate is in her future.

The key is the end of the fundraising quarter for federal office, which is Sept. 30.

Potential donors like to look at how well a candidate's fundraising does in the first quarter after he or she announces a run.

Announcing for a federal office between now and the end of the month would make it difficult to present a rosy financial picture to potential donors.

Everyone is waiting for the governor's decision.

2. Action Alert

from Ian Raymond, September 25, 2015

I received this email from Connor at NextGen, who has attended our Belknap County Democrats meetings. I've received similar emails from NH Sustainable Energy Association. Taking action is critical if we want to prevent an abrupt ending to the implementation of clean renewable energy here in NH. I am currently working on a project with a local school that will not go forward if net metering is closed to new installations.

It is my understanding that 3 or 4 new Legislative Service Requests will be dealing with raising this arbitrary cap, but unless a special session is called, these bills will not be signed into law quickly enough to prevent an interruption of this incentive program. And as we all know, one of the biggest impediments to renewable energy in NH is the uncertainty created in the marketplace by energy policies that are continually "on again, off again". Please take a moment to urge the Governor to take up this matter in a special session.

Thank you in advance...

Ian

Forwarded message:

I just wanted to let you know that NextGen is currently working to urge the Governor and the legislature to address the net metering crisis in New Hampshire. We can use all of the help that we can get to save renewable energy in the state, and it would be great if you, and the members of the Belknap County Democrats could help us out! I know this may not be the most exciting issue, but without net metering, it will be very difficult for people and businesses in New Hampshire to install renewable energy systems. If you could help us by sending the following message to your email lists, I would greatly appreciate it!

Please click the link below to tell the Governor and your legislators that they need to address the net metering crisis.

As I’m sure you know, net energy metering, a billing arrangement that allows homeowners and businesses to sell energy back to the utility companies when they generate renewable energy, is a vital part of our state's renewable energy infrastructure. Unfortunately, state legislation caps the amount of energy that can be produced by net metered systems - and we've already reached the cap in some parts of the state.

We need immediate action to protect the future of renewable energy in New Hampshire – visit the website below to tell Governor Hassan and our state legislators that they need to act now to support clean energy.

Please let me know if you have any questions, as I would be more than happy to address any concerns that you may have.

Sincerely,

Connor Corpora

Concord/North Regional Field Director

NextGen New Hampshire

3. Legislative Commission Meetings

Committees focus on campaign finance, renewable energy

by the Associated Press, concordmonitor.com, September 27, 2015

CONCORD, N.H. (AP) — How much economic activity is generated by the arts and culture in New Hampshire? Should towns and cities be allowed to purchase military style equipment, such as Bearcats? Are public schools appropriately taking care of the needs of dyslexic students?

All of these topics are the subject of legislative commissions scheduled to meet this week in Concord.

Lawmakers often create study commissions when they need more time to evaluate a topic before passing legislation. And the months between June and January, when lawmakers aren't in weekly sessions, serve as a prime time for that research and debate to take place. Nearly 15 commissions or committees will meet this week.

Several committees focus on hot-button political issues. A bipartisan group of House members put together a committee to look at the private investments in energy efficiency programs. As New Hampshire seeks to expand its access to energy, people are increasingly looking at renewable but potentially expensive sources such as wind or solar.

Another committee, created by Democrats, is looking into the state's financial reporting system for political campaigns. Its members are tasked with evaluating voters' online access to polling place information as well as reports from political candidates and campaigns.

4. A State Income Tax Proposal

State Rep. proposes implementation of 3.75 percent income tax plan

by Cameron Paquette, eagletimes.villagesoup.com, September 26, 2015

Life free or die.

The infamous motto of the Granite State has long symbolized the state’s philosophy of maintaining a small, fiscally conservative government with little taxation — no taxation, in fact, when it comes to personal income.

One state representative is looking to potentially change that, however, with a proposal that would see the implementation of a 3.75 percent personal income tax and the repeal of the Statewide Property Tax, along with a variety of other changes to create a revenue neutral budget that shifts government revenue generation away from traditional sources, such as property taxes.

“We do need to lower our property taxes. If you talk to any member of legislature … the first thing they say is property taxes are too high,” said Merrimack County District 12 Rep. Paul Henle. “Two-thirds of money raised by state and local government comes from property taxes. It’s putting all your eggs in one basket.”

The NH Tax Shift Plan was placed as a legislative service request on Friday, Sept. 18 by Rep. Henle as a way to lower the property tax burden in the state. The plan would repeal the Business Enterprise Tax and lower the Business Profits Tax to 3.75 percent from 8.5 percent while also repealing the Statewide Property Tax and the Utility Property Tax, and reinstating Revenue Sharing. Taken together, Henle estimates that would produce $400 million of property tax relief to residential and commercial owners.

To pay for these tax cuts, the plan would establish a 3.75 percent income tax.

“The income tax would be a simple flat tax based on the federal form,” explained Henle. “You would start with the Adjusted Gross Income (AGI) from your federal form, take the same deductions and exemptions you do on the federal form and then pay 3.75 percent of that. You would get a credit for any income tax you pay to other states.”

This is where things get sticky, as the current governor has taken what is known as “The Pledge,” making any support of implementing an income tax highly unlikely.

Sullivan County District 10 Rep. John Cloutier, of Claremont, feels that the plan is unlikely to succeed, but may stimulate a conversation regarding a shift in thinking on taxation in the state.

“As far as the proposal itself, I find it interesting. I don’t know how far it’s going to get” said Cloutier. “If it’s done right, it could help Claremont.

“We do need to lower our property taxes. If you talk to any member of legislature … the first thing they say is property taxes are too high,” said Merrimack County District 12 Rep. Paul Henle. “Two-thirds of money raised by state and local government comes from property taxes. It’s putting all your eggs in one basket.”

The NH Tax Shift Plan was placed as a legislative service request on Friday, Sept. 18 by Rep. Henle as a way to lower the property tax burden in the state. The plan would repeal the Business Enterprise Tax and lower the Business Profits Tax to 3.75 percent from 8.5 percent while also repealing the Statewide Property Tax and the Utility Property Tax, and reinstating Revenue Sharing. Taken together, Henle estimates that would produce $400 million of property tax relief to residential and commercial owners.

To pay for these tax cuts, the plan would establish a 3.75 percent income tax.

“The income tax would be a simple flat tax based on the federal form,” explained Henle. “You would start with the Adjusted Gross Income (AGI) from your federal form, take the same deductions and exemptions you do on the federal form and then pay 3.75 percent of that. You would get a credit for any income tax you pay to other states.”

This is where things get sticky, as the current governor has taken what is known as “The Pledge,” making any support of implementing an income tax highly unlikely.

Sullivan County District 10 Rep. John Cloutier, of Claremont, feels that the plan is unlikely to succeed, but may stimulate a conversation regarding a shift in thinking on taxation in the state.

“As far as the proposal itself, I find it interesting. I don’t know how far it’s going to get” said Cloutier. “If it’s done right, it could help Claremont.

“It’s more to start a conversation, because it’s going to have an uphill fight,” he continued. “If it comes to the floor with support, I will vote for it. Claremont needs property tax relief.”

Currently, Claremont has the highest property taxes in the state at $41.33 per $1,000 valuation. According to Henle, this could be cut by 10 percent if his plan is implemented to the fullest extent. Henle has until Oct. 30 to decide whether he will file the bill. Until then, he has been talking to businesses and organizations, receiving mixed responses.

“The feedback I get is pretty consistent. It’s based on the baggage this issue has,” said Henle, who’s having trouble finding someone to “stick their head up above the fox holes.”

“Nobody wants to go first,” he said.

More information on Henle's plan can be found at nhtaxshift.com

5. Marijuana Decriminalization in the State Senate

MARIJUANA DECRIMINALIZATION IN 2016?

by LFDA Highlights, lfda.org, September 27, 2015

So far at least five state Representatives have requested 2016 bills to decriminalize or legalize marijuana in New Hampshire.

Last spring a marijuana decriminalization bill passed the New Hampshire House with a veto-proof majority. The bill stalled in the Senate, despite reports that Gov. Maggie Hassan (D) was open to signing the bill.

After analyzing the Senators' voting records and issue positions, here are where we think the Senators stand:

Yes, Decriminalize

JEFF WOODBURN (DEMOCRAT DISTRICT 1)

When Sen. Woodburn took our 2014 survey he said, "We should revise the present law on marijuana to make it less punitive." He voted in favor of decriminalizing marijuana in 2015.

DAVID WATTERS (DEMOCRAT DISTRICT 4)

Sen. Watters may have voted against decriminalization in 2010 and 2012, but he voted in favor of decriminalization in 2015. He also wrote on his 2014 LFDA survey, "We should revise the present law on marijuana to make it less punitive."

DAVID PIERCE (DEMOCRAT DISTRICT 5)

Sen. Pierce has voted in favor of marijuana decriminalization more than once.

MOLLY KELLY (DEMOCRAT DISTRICT 10)

Sen. Kelly voted in favor of marijuana decriminalization in 2015.

BETTE LASKY (DEMOCRAT DISTRICT 13)

Sen. Lasky also voted for marijuana decriminalization in 2015.

DAN FELTES (DEMOCRAT DISTRICT 15)

Sen. Feltes joined many other Senate Democrats to support decriminalization in 2015.

JOHN REAGAN (REPUBLICAN DISTRICT 17)

Sen. Reagan voted for marijuana decriminalization in 2010, 2012, and 2015.

DONNA SOUCY (DEMOCRAT DISTRICT 18)

Sen. Soucy voted for the 2015 marijuana decriminalization bill.

LOU D'ALLESANDRO (DEMOCRAT DISTRICT 20)

On the 2014 LFDA survey Sen. D'Allesandro wrote, "We should revise the present law on marijuana to make it less punitive." He voted to move marijuana decriminalization forward in 2015.

MARTHA FULLER-CLARK (DEMOCRAT DISTRICT 21)

On the 2014 LFDA issue survey, Sen. Fuller-Clark wrote, "The possession of small quantities of marijuana should not be a crime." She also voted to move marijuana decriminalization forward in 2015.

On the Fence

JEB BRADLEY (REPUBLICAN DISTRICT 3)

When Sen. Bradley took our 2014 survey he said, "We should revise the present law on marijuana to make it less punitive." He also worked on last year's compromise marijuana decriminalization bill. However, Sen. Bradley ultimately joined with most of his fellow Republicans to block the 2015 marijuana decriminalization bill.

ANDREW HOSMER (DEMOCRAT DISTRICT 7)

Sen. Hosmer wrote on his 2014 LFDA survey, "We should revise the present law on marijuana possession to make it less punitive. At this time I do not support the de-crim of marijuana, but I would focus on rehabilitation." He initially voted against decriminalization in 2015, but also voted in favor of an amendment to the bill that would have helped the bill pass.

JERRY LITTLE (REPUBLICAN DISTRICT 8)

On his 2014 LFDA survey Sen. Little wrote, "As with many of these questions, the devil is in the details, and the answer is not as simple as checking one of the three choices offered. I would like us to consider decriminalizing possession of small quantities of marijuana, but need to know what a 'small quantity' is. How many violations are allowed? Will penalties increase for repeat offenders? Are penalties greater or less for minors? How will we handle dealers who modify their business plans to fall under the threshold to avoid stiffer penalties?" He voted against decriminalization in 2015, but his survey response indicates he is open to a decriminalization bill.

ANDY SANBORN (REPUBLICAN DISTRICT 9)

Sen. Sanborn voted to consider marijuana decriminalization in 2015, but ultimately joined with fellow Republicans to kill an amendment that would have paved the way for decriminalization.

KEVIN AVARD (REPUBLICAN DISTRICT 12)

Sen. Avard has an interesting take on marijuana decriminalization. On our 2014 LFDA survey he wrote, "this question should be left to the people to decide....as in fact that we are still under prohibition with alcohol and it being a state controlled substance . we should have a ballot aniciative asking the people to vote on it. [sic]" He voted to consider decriminalization in 2012 and 2015, but ultimately joined with fellow Republicans to kill an amendment that would have paved the way for decriminalization in 2015.

REGINA BIRDSELL (REPUBLICAN DISTRICT 19)

Sen. Birdsell voted to consider the 2015 marijuana decriminalization bill, but ultimately joined with Republicans to kill a key amendment to that bill. She also voted against decriminalization in 2014.

NANCY STILES (REPUBLICAN DISTRICT 24)

On the 2014 LFDA survey Sen. Stiles wrote, "We should revise the present law on marijuana possession to make it less punitive." She also voted to consider the 2015 marijuana decriminalization bill, before joining with other Republicans to defeat an amendment that would have moved the bill forward.

No, Don't Decriminalize

JEANIE FORRESTER (REPUBLICAN DISTRICT 2)

Sen. Forrester was a vocal opponent of marijuana decriminalization in 2015. She questioned the logic of decriminalizing marijuana after increasing funding for substance abuse treatment in the state budget.

SAM CATALDO (REPUBLICAN DISTRICT 6)

Sen. Cataldo voted against decriminalization in 2012 and 2015. On his 2014 LFDA survey he wrote, "The present law on marijuana should remain unchanged."

GARY DANIELS (REPUBLICAN DISTRICT 11)

Sen. Daniels voted against decriminalization in 2015, 2014, 2012, and 2010, and he spoke against marijuana decriminalization on the Senate floor last year.

SHARON CARSON (REPUBLICAN DISTRICT 14)

Sen. Carson spoke against marijuana decriminalization on the Senate floor in 2015, and helped defeat the amendment that would have paved the way for decriminalization.

DAVID BOUTIN (REPUBLICAN DISTRICT 16)

Sen. Boutin was another Senator to speak against marijuana decriminalization in 2015. Sen. Boutin is on record against decriminalization as far back as 2010, when he took the LFDA issue survey.

CHUCK MORSE (REPUBLICAN DISTRICT 22)

Sen. Morse voted against marijuana decriminalization in 2015.

RUSSELL PRESCOTT (REPUBLICAN DISTRICT 23)

On the 2014 LFDA survey Sen. Prescott wrote, "We should revise the present law on marijuana possession to make it less punitive." However, he voted against marijuana decriminalization in 2015.

AND NATIONALLY

6. Going Backwards For a Generation

960&_hsenc=p2ANqtz--

The typical male U.S. worker earned less in 2014 than in 1973

by David Wessel, brookings.edu, September 18, 2015

The typical man with a full-time job–the one at the statistical middle of the middle–earned $50,383 last year, the Census Bureau reported this week.

The typical man with a full-time job in 1973 earned $53,294, measured in 2014 dollars to adjust for inflation.

You read that right: The median male worker who was employed year-round and full time earned less in 2014 than a similarly situated worker earned four decades ago. And those are the ones who had jobs.

This one fact, tucked in Table A-4 of the Census Bureau’s annual report on income, is both a symptom of an economy that isn’t delivering for many ordinary Americans and at least one reason for the dissatisfaction, anger, and distrust that voters are displaying in the 2016 presidential campaign.

What about women? Well, they haven’t closed the pay gap with men, but the inflation-adjusted earnings of the median female worker increased more than 30% between 1973 and 2014, to $39,621 from $30,182, according to census data.

But back to men. Why are wages for the typical male worker stagnating? After all, the U.S. economy has grown substantially since 1973. Output per person in the U.S. has nearly doubled since 1973, according to the Bureau of Economic Analysis. And output per hour of work (minus depreciation) has increased nearly 2.5 times, according to a recent analysis by the Economic Policy Institute, a left-leaning think tank that produces reliable statistical analyses.

As I often do when confronted with puzzles like this, I contacted Larry Katz, the Harvard University labor economist.

He identified three factors to explain the stagnation of men’s wages:

1. Although this is not the major factor, workers have been getting more of their compensation in benefits as opposed to the cash wages that the Census tallies. (The EPI chart takes that into account and tracks total compensation.)

2. Labor’s share of national income has been declining since 2000 and capital’s share has been rising. Labor’s compensation (wages and benefits) has not been keeping pace with productivity growth. In their new analysis of this phenomenon, EPI’s Josh Bivens and Larry Mishel argue, “ This decoupling coincided with the passage of many policies that explicitlyaimed to erode the bargaining power of low- and moderate-wage workers in the labor market.”

3. The “most important factor,” Mr. Katz says, is the rise in wage inequality, the gap between the earnings of the best-paid workers and the ones at the middle and the bottom that has been widening steadily since about 1980. Economists differ over how much of this is the result of globalization, technological change, changing social mores, and government policies, but there is no longer much dispute about the fact that inequality is increasing.

It’s easy for Republicans to blame wage stagnation on Democrats and vice-versa. It’s not hard to understand why so many voters (who don’t need Census Bureau tables to understand what’s happening to their paychecks) are drawn to candidates who acknowledge this reality, lambast incumbents for not doing more to address it, and style themselves as outsiders with fresh approaches to one of the nation’s most alarming economic problems.

7. Who Are the Non-Voters, and Why It Matters [long read]

Why Non-Voters Matter

A new study suggests that increasing turnout could have significant ramifications for policy.

by Sean McElwee, theatlantic.com, September 15, 2015

In 2014, just 41.9 percent of the voting-age citizen population of the United States voted. But the people who voted are not only in the minority, they form an unrepresentative minority. Millions of Americans are too young to vote. Others are disenfranchised felons, unable to vote for health reasons, missed registration deadlines, stuck at work, dissuaded by voter ID laws. In many salient ways, voters are not like nonvoters: voters are richer, whiter, and older than other Americans. And my new report, Why Voting Matters, shows how their votes produce a government that caters to their interests—and how boosting turnout would lead to a more representative democracy.

Political scientists once accepted the idea that voters were a “carbon copy” of the nonvoting population. In 1999, Benjamin Highton and Raymond E. Wolfinger summarized this consensus, writing that, “simply put, voters’ preferences differ minimally from those of all citizens; outcomes would not change if everyone voted.” More recently, though, that view has come under attack. Jan Leighley and Jonathan Nagler, a pair of political scientists, argue that gaps between voters and nonvoters are real and have widened, and that the divergence in their views is particularly acute on issues related to social class and the size of government. However, measures that examine a one dimensional left-right axis obscure these divides.

Census data on the 2014 midterm elections quantifies some of these gaps. While 52 percent of those earning more than $150,000 voted, only 24 percent of those earning less than $10,000 went to the polls. That divide is further magnified by age. Among 18-24 year olds earning less than $30,000 turnout was 17 percent in 2014, but among those earning more than $150,000 and older than 65, the turnout rate was nearly four times higher, at 65 percent. There were also racial gaps in voter turnout. In 2014, 46 percent of white voters turned out to vote, compared to 40 percent of black voters, and just 27 percent of Asians and Latinos.

Percent Voting, by Family Income Bracket (2012 and 2014)

Policy Preferences

It’s not just the demographics of voters and nonvoters that differ; so do their views. Four questions from the American National Elections Studies (ANES) data show a stark divide on issues related to economic inequality. Nonvoters tend to support increasing government services and spending, guaranteeing jobs, and reducing inequality—all policies that voters, on the whole, oppose. Both groups support spending on the poor, but the margin among nonvoters is far larger. Across all four questions, nonvoters are more supportive of interventionist government policies by an average margin of 17 points.

Political scientists once accepted the idea that voters were a “carbon copy” of the nonvoting population. In 1999, Benjamin Highton and Raymond E. Wolfinger summarized this consensus, writing that, “simply put, voters’ preferences differ minimally from those of all citizens; outcomes would not change if everyone voted.” More recently, though, that view has come under attack. Jan Leighley and Jonathan Nagler, a pair of political scientists, argue that gaps between voters and nonvoters are real and have widened, and that the divergence in their views is particularly acute on issues related to social class and the size of government. However, measures that examine a one dimensional left-right axis obscure these divides.

Census data on the 2014 midterm elections quantifies some of these gaps. While 52 percent of those earning more than $150,000 voted, only 24 percent of those earning less than $10,000 went to the polls. That divide is further magnified by age. Among 18-24 year olds earning less than $30,000 turnout was 17 percent in 2014, but among those earning more than $150,000 and older than 65, the turnout rate was nearly four times higher, at 65 percent. There were also racial gaps in voter turnout. In 2014, 46 percent of white voters turned out to vote, compared to 40 percent of black voters, and just 27 percent of Asians and Latinos.

Percent Voting, by Family Income Bracket (2012 and 2014)

It’s not just the demographics of voters and nonvoters that differ; so do their views. Four questions from the American National Elections Studies (ANES) data show a stark divide on issues related to economic inequality. Nonvoters tend to support increasing government services and spending, guaranteeing jobs, and reducing inequality—all policies that voters, on the whole, oppose. Both groups support spending on the poor, but the margin among nonvoters is far larger. Across all four questions, nonvoters are more supportive of interventionist government policies by an average margin of 17 points.

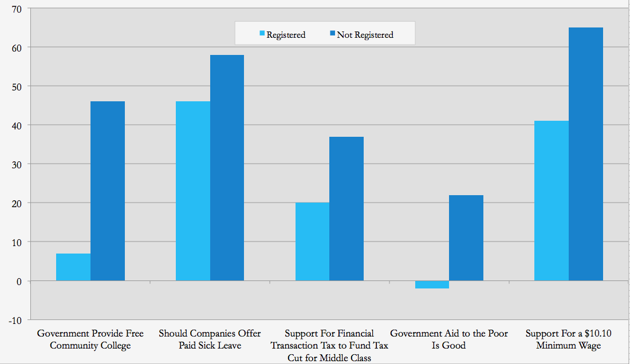

Net Support of Policy, Voters and Nonvoters

Net Support of Policy, Rich Voters and Poor Nonvoters

YouGov, Pew, Demos (Sean McElwee)

That’s a remarkable finding, because there’s a mass of evidence to suggest that the views of voters play a hugely significant role in changing policy. Brian Newman and John Griffin, who have found that voters are “almost always more conservative” than nonvoters, have argued that, “increases in turnout may lead to greater policy liberalism.” While many scholars have focused on the rather pedestrian question of whether turnout would benefit Republicans or Democrats, Griffin and Newman argue that even beyond the party differences, “voter ideology substantially affects the way Senators cast votes.” They note, for example, that, “in states where voters are more conservative than nonvoters, Senators tend to be more conservative.” Other recent st

Negative numbers indicate that nonvoters are more liberal than voters. (Source: Griffin and Newman, 2005)

Higher income bias indicates more high-income voting; higher anti-redistribution bias indicates that voters are more likely to oppose redistribution than nonvoters. (Source: Henning Finseraas, 2007)

Vincent Mahler, 2008

There are many reasons why people don’t vote, but research suggests that three factors are particularly crucial: registration, unions, and parties.

Registration is a barrier that exists in the United States but not in any other country in the developed world. Political scientists have shown that the requirement to register dramatically reduces voter turnout. This effect primarily hurts the poor. One study finds that, “states with restrictive voter registration laws are much more likely to be biased toward upper-class turnout.” But if so, America is moving in the wrong direction. In the wake of a recent Supreme Court case restricting the Voting Rights Act, states have begun to pass an increasing number of restrictive voter ID laws, with racially disparate impacts.

There are other barriers to voting as well. Counties with large black populations are less likely to have access to early voting. Felon disenfranchisement disproportionately reduces turnout among potential voters of color and those with low-incomes, and explains some of the decline in voter turnout over the last few decades. (There is a strong correlation between the pervasiveness of racial bias in a state and the ease of access for a state’s voting system.) Conversely, arecent study suggests that easier access to voting does indeed boost turnout.

Unions were once key catalysts for voter turnout, but without them, turnout has slipped. In a recent study, Jasmine Kerrissey and Evan Schofer find that, “union membership is associated with many forms of political activity, including voting, protesting, association membership, and others. Union effects are larger for less educated individuals, a group that otherwise exhibits low levels of participation.” This is important because these activities, like voting, tend to be dominated by the wealthy. However, as unions have declined in power and influence, so has turnout among low- and middle-income people.

In low turnout elections, politicians are incentivized to cater to the interests of a small portion of the general public.

It’s not just unions that are no longer moving blue-collar voters to the polls. Parties have systematically failed to mobilize low-income voters. Between the 1960s and the 1980s, political scientists Steven J. Rosenstone and John Mark Hanse argue, half the decrease in turnout can be attributed to less effort by political parties to contact voters. The rate at which the Democratic Party reached out to high-income voters increased nearly four-fold between 1980 and 2004. In 2004, high income Americans were nearly three times more likely to be mobilized by the parties. In tight elections, however, when parties compete and Democrats are forced to mobilize low-income voters, the turnout gap declines.

It may be that those who have the most to lose from lower turnout among low-income voters least understand its significance. Although the parties have dramatically polarized in the last few decades, lower-income people and nonvoters remain largely unaware of this dramatic shift, and may be inclined to believe that there are few differences between the parties. In their book, Leighley and Nagler find that “those in the top income quintile see a larger difference between the candidates on ideology than do those in the bottom quintile.”

If the public wants to increase turnout, this research suggests a clear set of tools for accomplishing that. First, remove the barriers to registration. Vigorous enforcement of the National Voter Registration Act, combined with same-day or automatic voter registration, could substantially increase access to the polls. Second, create more competitive elections, to incentivize parties to mobilize low-income people. Third, since the decline in unionization has also contributed to the decline in low and middle-income mobilization, unions need to be revived or replaced. (Or, to flip that around, increasing turnout may be the best hope unions have for revival.)

Inequality creates a worrying double-bind: Low-income people become more supportive of interventionist policies, even as they drop out of the political system. The result is a troubling divergence between the economic views of the population as a whole, and the policies that voters and the politicians that they elect tend to favor. The simplest way to reverse that is to mobilize the great mass of potential voters who don’t currently head to the polls. Universal registration, Jan Leighley said, would lead to a “more serious conversation about economic inequality, and one that included a wider range of views.”

Conclusion

Higher turnout may lead to policies that somewhat better reflect the views of poor and middle-class Americans, but other factors will continue to favor the affluent. Members of Congress tend to come from white-collar occupations, and may therefore be less likely to support policies that benefit blue-collar workers. They are also wealthier than the average citizen, and perhaps unsurprisingly,more favorably inclined to policies like eliminating the estate tax that yield disproportionate benefits for the wealthy. More affluent Americans remain more likely to contact members of Congress, to work on campaigns, to donate to funds, or to have social networks that include elected officials.

Spencer Piston, ANES 2012

8. Profiteering

Daraprim 'Profiteering' Controversy Lifts Lid on Soaring Cost of Prescription Drugs

by Suzanne McGee, readersupportednews.com, September 27, 2015

Beyond Martin Shkreli’s behavior, the price of medications pits the interests of patients against the profits of two big industries – pharmaceuticals and insurance

Until this week most of us had never heard of Daraprim, a drug that fights toxoplasmosis. But after the decision of the drug’s new owner, Turing Pharmaceuticals, to boost its cost per pill from $13.50 to a whopping $750, we’re all unlikely to forget its name or the name of Turing’s owner, 32-year-old Martin Shkreli.

Shkreli became one of the most hated men in America last week, Hillary Clinton called for reforms in the drug market, social media tore him to shreds, a punk label he bankrolled severed ties with him and even Donald Trump weighed in, calling him a “spoiled brat”.

He’s now pledged to cut the price – he hasn’t said by how much or when – but the outrage over the astronomical hike in a life-saving drug has opened the doors to a fast-moving and furious debate about the soaring costs of prescription medications in the United States – one that is long overdue.

While from a scientific and business perspective, we may be in the midst of a new “golden age”for pharmaceutical innovation and research and development in the drug industry, the costs of these new wonder drugs may drive the system – and the individuals within it – to the brink.

Daraprim is a particularly egregious example of how broken the system is because it isn’t a new and complex wonder drug, but something that has been around since the 1940s. Logic suggests that drugs that have been around for a while should decline in price, in part because they are cheap and easy to make; in part because they face competition from generic manufacturers. It turns out that isn’t the case.

Part of the problem is that there are individuals like Shkreli scouring the market for drugs like Daraprim that don’t have effective generic rivals (perhaps that market is too small for a generic drug maker to view it is profitable; perhaps, as in Daraprim’s case, there are unique issues surrounding the requirements for regulatory testing) or other factors that give the drug a lot of effective pricing power. The profit-minded individual or company snaps up the patents, suddenly hikes the drug’s price and puts consumers – from insurance companies to individuals – in a position of either paying what is demanded or going without.

Late this summer, Rodelis Therapeutics boosted the cost of 30 tablets of cycloserine, a tuberculosis drug, from $500 to $10,800. When the Mayo Clinic made the price hike public, the company returned the rights to the medication to the Chao Center for Industrial Pharmacy & Contract Manufacturing, from which it had acquired them. Early in the year, Valeant Pharmaceuticals International Inc boosted the prices of two heart drugs, Nitropress and Isuprel, by 525% and 212% on the same day that they acquired them. “Our duty is to shareholders and to maximize the value” of Valeant’s products, a company spokeswoman told the Wall Street Journal at the time.

I’ve encountered this first hand. When I started freelancing in 2002, I began paying for my own medication to treat my chronic migraines: Fioricet with codeine. Back then, the cost to me of the brand (the only kind that Walgreen’s stocked – they claimed that no generic version existed) was $220 per month. By 2005, it was $350. By 2007, $450. In 2009, it was well north of $500. That was the year that I moved pharmacies and finally discovered a generic. But then the cost of the generic, too, began to climb – from $120 to $160 and then to north of $200 a month. Just because a drug is a genericdoesn’t make it immune from big price increases, as industry mergers and decisions by manufacturers to stop producing some drugs have affected availability of some medications.

At least with insurance (although that insurance premium isn’t cheap), the medications I have to take are at least affordable, because my insurer will cover them. In the cases of some of the newest and most costly bleeding-edge drugs, the jury is out on whether that will happen.

A case in point is the newest treatments for hepatitis C, sold by Gilead Science and AbbVie, which appear to cure more than 90% of those infected with the potentially fatal liver disease. More than three million Americans are estimated to have hep C, which can be spread, among other things by poorly sterilized medical instruments, as well as (in prior decades) blood transfusions, as well as sharing needles among drug addicts, and can result in cirrhosis, cancer and ultimately death. The new drugs, including Harvoni, can effect a complete cure in as little as three months, with few side-effects, and even prevent the scarring. The price tag, however, is astronomical: as much as $94,500.

Unsurprisingly, insurers are balking at footing the bill – even though it’s significantly cheaper than paying out $175,000 or so to cover a liver transplant a few years down the road. (Perhaps they’re reading the actuarial tables, and gambling that livers won’t become available in time for a transplant and that this actually is a better bet?) They insist that the newer drugs haven’t been tested in as many people as the typical drugs and so they are only approving treatments for those with advanced liver disease.

That’s prompting patients trying to avoid ending up with irreversible damage to their organs tosue their insurers. Insurers, for their part, point out that while these drugs represent a tiny fraction of prescriptions written for their members – perhaps 1% – they can make up as much of a quarter of all spending on drugs, as is the case at Blue Cross Blue Shield of Massachusetts.

Obamacare may have made basic healthcare – flu shots, a visit to the doctor’s office, and such basic expenses – accessible and affordable, to some extent and with varying degrees of success. (Yes, your favorite doctor may not participate in the plan that you can afford; yes, while some of us pay less, others may find themselves paying more every month in premiums.) But the cost of prescription medication is one area that remains largely unaddressed, and has the potential to be even more perilously complicated to try to resolve: it involves not one, but two sets of for-profit interests, the pharmaceutical companies who research and develop the increasingly sophisticated products to treat diseases that once had few effective medications, and the insurance companies that must find a way to collect enough premiums from you and me to pay for it all and still make money for their shareholders.

It’s no wonder that the Daraprim debacle has drawn the attention of political candidates on both sides of the aisle. Even Donald Trump, that promoter of free enterprise, appeared to draw the line at Shkreli’s attempt to profiteer, being quoted as calling him “a spoiled brat” and describing his actions as “disgusting”. For their part, Democratic presidential candidates Hillary Clinton and Bernie Sanderstook to the campaign trail to talk about the need to curb drug price increases. As a populist strategy, it’s got to be a winning one. But any attempt to craft new policies around the ideas they are discussing may unleash a battle with insurers and with the pharmaceutical industry that makes the struggle over Obamacare look like a pleasant afternoon stroll on the beach.

FINALLY doubling up

No comments:

Post a Comment