AROUND NEW HAMPSHIRE

1. First Meeting for the Substance Abuse Task Force

State's drug abuse task force to hold first session today

by Garry Rayno, unionleader.com, November 24, 2015

CONCORD — The 26-member opioid abuse task force will have a long day today at its initial meeting, hearing from people directly involved in the crisis.

The 15 Republicans and 11 Democrats will hear from nonprofit sector officials and first responders, along with Gov. Maggie Hassan and Attorney General Joseph Foster.

Among those speaking to the group will be State Police Col. Robert Quinn and Manchester Police Chief Nick Willard, representing law enforcement; physicians Seddon Savage and Travis Harker and Governor’s Commission on Alcohol and Drug Abuse Prevention, Treatment and Recovery Chairman Tym Rouke.

Officials from Hope for New Hampshire Recovery, which recently announced a partnership that will transform the old Hoitt’s Furniture building on Valley Street in Manchester into a recovery treatment center, will speak to the task force, along with New Futures head Linda Paquette.

First responders from the Manchester Fire Department will talk to the group as will several officials from New Jersey to discuss efforts in that state.

Over the next six weeks the task force will focus on six areas: making the penalties for fentanyl distribution the same as heroin, streamlining insurance company authorization for substance abuse treatment, enhancing the prescription drug monitoring program and making it mandatory, expanding drug courts, increasing prescriber education standards, and expanding a pilot program targeting drug sales.

Subcommittees will focus on specific areas. The task force is expected to release its final report Jan. 6 in the form of bills lawmakers can quickly approve and send to the governor.

Among the members of the task force are the majority and minority leaders of the House and Senate, the chairs or vice chairs and ranking minority members of the House and Senate judiciary, finance, health and human services, and executive departments and administration committees, and the House Criminal Justice Committee.

The panel includes the three Manchester senators and one Manchester representative. Manchester is considered the community hardest hit by the epidemic. Hassan successfully petitioned the Executive Council to call a special session so lawmakers could focus on the issue and approve legislation before the next session begins in January but the Republican leaders of the House and Senate proposed the task force to vet proposed legislation so it will be ready for lawmakers to act in January so the governor can sign it into law.

The task force plan passed the House and Senate last week by large margins.

The task force meets at 9 a.m. in rooms 210-211 of the Legislative Office Building.

The 15 Republicans and 11 Democrats will hear from nonprofit sector officials and first responders, along with Gov. Maggie Hassan and Attorney General Joseph Foster.

Among those speaking to the group will be State Police Col. Robert Quinn and Manchester Police Chief Nick Willard, representing law enforcement; physicians Seddon Savage and Travis Harker and Governor’s Commission on Alcohol and Drug Abuse Prevention, Treatment and Recovery Chairman Tym Rouke.

Officials from Hope for New Hampshire Recovery, which recently announced a partnership that will transform the old Hoitt’s Furniture building on Valley Street in Manchester into a recovery treatment center, will speak to the task force, along with New Futures head Linda Paquette.

First responders from the Manchester Fire Department will talk to the group as will several officials from New Jersey to discuss efforts in that state.

Over the next six weeks the task force will focus on six areas: making the penalties for fentanyl distribution the same as heroin, streamlining insurance company authorization for substance abuse treatment, enhancing the prescription drug monitoring program and making it mandatory, expanding drug courts, increasing prescriber education standards, and expanding a pilot program targeting drug sales.

Subcommittees will focus on specific areas. The task force is expected to release its final report Jan. 6 in the form of bills lawmakers can quickly approve and send to the governor.

Among the members of the task force are the majority and minority leaders of the House and Senate, the chairs or vice chairs and ranking minority members of the House and Senate judiciary, finance, health and human services, and executive departments and administration committees, and the House Criminal Justice Committee.

The panel includes the three Manchester senators and one Manchester representative. Manchester is considered the community hardest hit by the epidemic. Hassan successfully petitioned the Executive Council to call a special session so lawmakers could focus on the issue and approve legislation before the next session begins in January but the Republican leaders of the House and Senate proposed the task force to vet proposed legislation so it will be ready for lawmakers to act in January so the governor can sign it into law.

The task force plan passed the House and Senate last week by large margins.

The task force meets at 9 a.m. in rooms 210-211 of the Legislative Office Building.

Hassan: More die from drug overdoses than car crashes

by Holly Ramer, Associated Press, vnews.com, November 24, 2015

CONCORD, N.H. (AP) — Drug overdoses have become the second most common cause of death in New Hampshire and could move into the top spot soon, Gov. Maggie Hassan told lawmakers Tuesday as they began tackling the state's substance abuse crisis.

Hassan was the first speaker to address a task force that will spend the next six weeks studying the issue and developing bills the Legislature will consider when its new session starts in January. She urged members to consider several proposals, include strengthening the state's prescription monitoring program, reducing the over-prescription of powerful pain medication, providing additional support to law enforcement, and streamlining access to substance abuse treatment and recovery services.

"There may be some who say we can't afford to invest in these steps. I say we can't afford not to," she said. "Every month we lose dozens of our fellow citizens, our families lose loved ones and our businesses lose valuable workers. Our future shrinks before us. We must act now."

Drug overdose deaths in New Hampshire climbed from 192 in 2013 to 326 last year, and nearly 300 have died so far this year. Hassan cited 2013 and 2014 data from the Centers for Disease Control and Prevention that show deaths from overdoses exceeding deaths from motor vehicle crashes, diabetes, kidney disease and several common cancers. If all cancer deaths are combined, they exceed overdose deaths.

"If current trends continue, overdoses will likely overtake Alzheimer's as the leading cause of death in our state," she said.

The task force also heard from law enforcement officials, medical providers and those involved in substance abuse treatment and recovery.

Tym Rourke of the New Hampshire Charitable Foundation urged the task force to look beyond the specific drugs that have risen to the forefront and enact legislation that would address the state's larger problems with alcohol and substance abuse. He described hearing from a distraught mother in 1995 struggling to find treatment for her daughter who lamented, "I would have to dig my daughter out of a ditch dead before anybody in the state of New Hampshire would care."

"This crisis is not new," said Rourke, who also leads the Governor's Commission on Alcohol and Other Drug Abuse Prevention, Treatment, and Recovery. "Why is it in New Hampshire and New England and not in other parts of the country? Is it cultural? Is it financing? Is it 'Live Free or Die?' Who knows. What I do know is our collective response to this epidemic for the last 30 years has been inadequate."

Building a prevention and treatment system that addresses only the opioid epidemic is the wrong approach, he said.

"We will get through this, and there will be something else on the other side," he said. "We need to finally build a system that addresses the state's drug and alcohol epidemic, and stop digging ditches."

2. From the Ignorance Caucus in the Legislature

Bill preventing mandatory flu shots for employees could be a problem for hospitals

by David Brooks, concordmonitor.com, November 24, 2015

Lawmakers may consider a bill next session that would prevent companies from requiring employees to get a flu shot, posing a potential problem for hospitals, which are graded by the federal government on this issue.

“I’m not anti-vaccine,” said state Rep. John Burt, a Goffstown Republican, the lead sponsor of the proposed bill. “Vaccines for measles, etc., ones like those, are fine. And if you want the flu shot, I say knock yourself out. But it shouldn’t be forced on you.”

The bill is currently an LSR, or Legislative Service Request, and the wording is being tweaked by suggestions from other legislators before it goes to initial committee, Burt said.

“The bill is kind of open for any vaccines at this point, but my main goal is the (flu vaccine). . . . They’re saying that the bill is pretty broad – and will probably refine it down,” Burt said.

If the bill becomes law, it would pose a quandary for hospitals, since the percentage of employees getting the flu vaccine is one of the measurements made by the federal government under a report known as HAI, or health care-associated infections. That report is used as a measure of quality, which can affect reimbursement under Medicaid.

The HAI report counts infections that occur during certain procedures, including the insertion of catheters, and some surgeries, such as hysterectomies and surgery on the heart, colon and knees.

It also measures how well hospitals follow procedures that can lessen the rate of infections, including practices during central line insertions and use of antimicrobials during surgery. This is where flu shot compliance comes in, since vaccines lessen the chance that flu infections will be spread to people visiting health care facilities.

Burt said he thought the value of the flu shot was not great enough to make its usage mandatory, and that the requirement was driven by hospitals’ wish to collect federal funding rather than concern about employees.

Burt said “hundreds” of nurses and other health-care workers would support such a bill.

“The employee has rights at their job not to be forced for a vaccination,” he said.

The flu vaccine is probably the most difficult of the major vaccines to develop because the influenza virus changes so much from year to year. Producing tens of millions of doses of flu vaccine takes many months and must begin well before flu season starts, so the vaccine is developed before it is certain which influenza strains will be most common.

Last flu season, there was a mismatch and the vaccine did not combat a strain known as A-H3, which proved particularly virulent. A total of 49 deaths were attributed to influenza in New Hampshire during flu season, more than any time in the previous two decades.

The Centers for Disease Control and Prevention recommends that everybody over the age of 6 months get an annual flu shot. In New Hampshire, the vaccine is free to everybody under the age of 18.

3. Ballot Challenge Denied

Challenge fails to block Sanders from NH ballot

by Kathleen Ronayne, Associated Press, vnews.com, November 24, 2015

CONCORD, N.H. (AP) — Vermont Sen. Bernie Sanders will appear on New Hampshire's Democratic presidential primary ballot.

The state's Ballot Law Commission unanimously supported Sanders' eligibility on Tuesday following a challenge based on his longtime status as an Independent.

The complainant was local attorney Andy Martin. He says Sanders' self-identification as an Independent on the U.S. Senate's website makes him ineligible to declare himself a Democrat in New Hampshire. The paperwork to run in the primary requires candidates to declare themselves a registered member of the party of the primary they intend to run in.

The New Hampshire Democratic Party and Democratic National Committee support Sanders' ability to run in their party's primary.

4. Another Ranking

NH ranked US's 3rd best state to live in

from nh1.com, November 24, 2015

We don't think it's new information that New Hampshire is a great place to live.

Just ask those who work at Time Magazine and ranked Bedford No. 21 on the “Best U.S. cities and towns to live in” list.

Don't want to take our word for it?

Another report yet again shined a light on how great of a place New Hampshire is to live.

According to 24/7 Wallet, of all 50 states, the Granite State is the third best place to live in America.

Although New Hampshire has one of the lowest concentrations of restaurants, bars and hotels in the country, it has some of the best income, unemployment rates and life expectancy rates in the states.

New Hampshire has the lowest poverty rate in the country at 9.2 percent compared to the national poverty rate at more than 15 percent.

New Hampshire also exceeds the national average life expectancy by more than two years. The life expectancy for babies born in N.H. is 80 years old.

Massachusetts and Connecticut take the top spots with the first and second best places to live.

[To see the full report, including comments on each state, and the criteria used, click on the following link:

AND NATIONALLY

5. Corporate Dodgers

Pfizer Buying Allergan So It Can Pretend To Be Irish In Tax Scam

by Dave Johnson, ourfuture.org, November 23, 2015

The pharmaceutical corporation Pfizer will acquire pharmaceutical corporation Allergan in a deal valued at $160 billion. My colleague Richard Eskow called this combination of Pfizer (the maker of Viagra) and Allergan (the maker of Botox) “a merger of false desire and false beauty.”

More to the point, this deal is structured as an “inversion” designed to dodge U.S. taxes. Allergan (itself the product of a similar inversion) is headquartered in New Jersey but for tax reasons is incorporated in Ireland – a tax haven. After the acquisition, Pfizer will keep its headquarters in New York but change its corporate address to Ireland.

In other words, the resulting merged company will make and sell products in the same places it makes and sells them now. The same executives will occupy the same buildings. It will receive the same taxpayer-funded U.S. services, infrastructure, courts and military protection that it receives now. But the company will now claim it is “based” in tax-haven Ireland and thereby dodge U.S. taxation.

It’s A Tax Dodge

This deal is entirely about dodging billions of tax dollars. The Washington Post Wonkblog explains, in “Pfizer and Allergan to merge in $160 billion inversion“:

Gustav Ando, research director for IHS Life Sciences, a business information and consulting company, said … “This merger isn’t meant to benefit patients; it isn’t meant to innovate in any kind of way. It’s basically a tax inversion strategy, and certainly the benefits won’t be passed on to consumers,” Ando said. “It’s pretty easy at the moment to paint the pharmaceutical industry in a negative light and this certainly doesn’t do anything to help the cause. It definitely increases the reputational risks to the industry.”

A Rigged System

Corporations receive immense benefits from operating in the United States. The United States provides the most well-developed business-enabling environment in the world, a strong customer base, a highly educated workforce, a developed infrastructure, patent and copyright protections, an advanced legal system and courts, police and other protections, military protection, government-funded scientific research, and so much more.

Corporations also get a lot of business from our government. Pfizer got $5.3 billion in federal contracts between 2010 and 2014. And Pfizer makes $1 billion a year from selling drugs to Medicare, Medicaid and other U.S. government programs. About 5 percent of Pfizer’s $20 billion annual U.S. revenue comes from the federal government and taxpayer dollars.

But corporations and shareholders enjoy lower tax rates than regular people do. The people who make a gain from trading corporate shares get a special, lower capital gains tax rate. (This capital gains tax rate is lower because the wealthiest make most of their income from capital gains, and the wealthiest make most of their income from capital gains because the capital gains tax rate is lower.)

And then, on top of that, corporations are able to lobby and otherwise use their immense wealth and power to influence our legal and tax system.

This is another example of how we have a rigged tax system, filled with loopholes and breaks that benefit wealthy CEOs and the 1 percent shareholders at the expense of the rest of us.

Pfizer Also Uses Deferral Loophole – $148 Billion Stashed Offshore

Pfizer reported that it lost an average of $3 billion in the U.S. but made $15 billion each year each year offshore over the last five years. But Pfizer had 40 percent of its sales and 50 percent of its assets in the U.S. in 2014. It looks a lot like Pfizer is engaged in schemes that make it appear as if its profits are really earned in tax havens rather than in the U.S. As a result of this kind of shifting, Pfizer currently has approximately $148 billion in untaxed profits stashed offshore on which it has paid ZERO U.S. income taxes. (See also The New York Timesand Los Angeles Times.)

It is highly likely that this inversion will enable Pfizer to dodge ever having to pay the taxes it owes on the approximately $148 billion of taxable profits it has kept out of the country. At the U.S. tax rate of 35 percent, this represents a tax-revenue loss of up to $51.8 billion that other taxpayers will have to make up for. It also provides Pfizer a substantial advantage over other companies that focus on innovation and serving customers instead of engaging in schemes to dodge taxes.

Who, Exactly, Benefits From This Rigged System?

When you hear that some “corporation” is doing something, what does this mean? Who, exactly, is getting the benefits of the things corporations do?

A corporation is really just a contract that enables the low-risk accumulation of investment to fund large-scale projects that would otherwise be difficult to accomplish. Multiple shareholders provide equity to the corporation and in return they have a claim on a share of any resulting profits. Shareholders receive “limited liability,” which means they are not liable for the debts and any other liabilities of the corporation. A corporation can get in a lot of trouble, financial and otherwise, and then just close up shop, divide its assets to its creditors, and the shareholders can just walk away, losing only the money they originally put in.

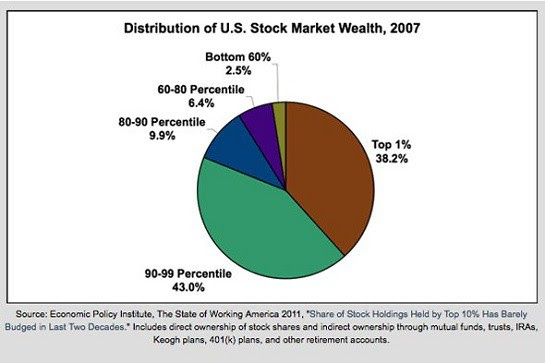

As of 2010, the top 1 percent owned 35 percent of corporate shares and the next 9 percent owned another 46 percent.

A lot of people see corporations as these anonymous entities with no actual human face. But as Mitt Romney reminded us in the 2012 presidential campaign, “Corporations are people, my friend.”

When you hear that “corporations” are benefiting from a tax break, subsidy, trade deal, rigged contract, whatever, you are really hearing about a few people benefiting. But not the rest of us.

Why Doesn’t Congress Fix This Rigged System?

A tax “loophole” lets Pfizer and other American companies renounce their U.S. citizenship to get out of paying their fair share of taxes. Congress could stop Pfizer from deserting America tomorrow. Legislation now waiting for a vote is stuck because conservatives in Congress will not let it be voted on. The legislation (S. 198 and H.R. 415) is sponsored by Sen. Dick Durbin (D-Ill.) and Rep. Sandy Levin (D-Mich.) and would apply to any direct or indirect inversion. (The Pfizer-Allergan merger is indirect.)

● The legislation would prevent the tax benefits of an inversion if a company has its headquarters in the United States. Pfizer is not moving to Ireland – its CEO, staff and facilities will remain here.

● The legislation requires that if the majority of a company’s shareholders are American, the company should be considered American. Pfizer’s original U.S. shareholders will own 56 percent of the merged company.

● Companies should not be able to desert America by changing their corporate address to a tax haven. Congress should pass this legislation before this deal is consummated by shareholders in coming months to ensure Pfizer pays its fair share of U.S. taxes.

The only reason this tax dodge has not been eliminated is that Republican leadership will not allow a vote to change this. If a vote were allowed there is no question Congress would fix this.

Clinton Condemns

Democratic presidential candidate Hillary Clinton released this statement through her campaign:

“For too long, powerful corporations have exploited loopholes that allow them to hide earnings abroad to lower their taxes. Now Pfizer is trying to reduce its tax bill even further. This proposed merger, and so-called ‘inversions’ by other companies, will leave U.S. taxpayers holding the bag. As President, I will fight to reform our tax system to reward growth, innovation, and job creation here in the United States. We cannot delay in cracking down on inversions that erode our tax base.“In the weeks ahead, I will propose specific steps to prevent these kind of transactions, which take advantage of loopholes that litter our tax code, distort incentives for investment, and disadvantage small businesses and domestic firms that cannot game the international tax system. I urge Congress to act immediately to make sure the biggest corporations pay their fair share, and regulators also should look hard at stronger actions they can take to stop companies from shifting earnings overseas. Republicans should stop trying to tilt the tax code even further in favor of the super wealthy and the largest corporations and join us in supporting these necessary reforms on behalf of U.S. taxpayers. We should come together to encourage investment and job creation here in the United States, not this kind of damaging gamesmanship.”

Sanders Condemns

Sen. Bernie Sanders issued the following statement today after Pfizer and Allergan announced they would merge in the largest inversion ever:

“The Pfizer-Allergan merger would be a disaster for American consumers who already pay the highest prices in the world for prescription drugs. It also would allow another major American corporation to hide its profits overseas. The Obama administration has the authority to stop this merger, and it should exercise that authority. Congress also must pass real tax reform that demands that profitable corporations pay their fair share of taxes.”

Giant corporations like Pfizer – and apparently the Republican leadership they are paying – know no country, they feel no patriotism, they have no allegiance to their customers or to the United States or its citizens. This is all about money.

6. Trickle-Up Economics

Trickle-Down Economics Must Die. Long Live Grow-Up Economics

by Scott Santens, huffingtonpost.com, November 18, 2015

For over thirty years we've treated something as fact which is actually false. Economists we trusted to know better didn't, and so people have suffered and continue to suffer. This pernicious economic myth is the idea that a rising yacht lifts all tides, or as more popularly described, "trickle-down economics." If we are to start running our economy in a way we could one day describe as notably less insane, we must finally come to see it for what it actually is.

An Undead Idea

This belief -- that it's good economics to give a relatively greater and greater share of the pie to the top of the economic spectrum because the absolute sizes of all remaining shares will grow -- has taken some mortal hits in recent years by some major players, most notably even the OECD and IMF. In fact, it has now reached the point such that the idea being left alive in the minds of anyone makes it a good candidate as an extra inThe Walking Dead.

Surveying the data, we'll start with Wall Street bonuses versus the economic multiplier effects of higher velocity money, go on to economic growth research in relation to distributional inequality, and end with what we know from global cash transfer evidence and the economic effects of billionaires. Let's burn this undead idea of inequality-driven economic growth with napalm and bury it in concrete, shall we?

This chart alone is perhaps enough to warrant a trip to the nearest window to shout out, "I'm mad as hell, and I'm not going to take this anymore!"

Wall Street earned twice as much in year-end bonuses alone as all full-time minimum wage workers combined earned the entire year.

What Mother Jones neglected to mention however is something that goes well beyond "fucked up," and something which did not go unmentioned in a piece by the Institute for Policy Studies after identical news the year before.

Every extra dollar going into the pockets of low-wage workers, standard economic multiplier models tell us, adds about $1.21 to the national economy. Every extra dollar going into the pockets of a high-income American, by contrast, only adds about 39 cents to the GDP. These pennies add up considerably on $26.7 billion in earnings. If the $26.7 billion Wall Streeters pulled in on bonuses in 2013 had gone to minimum wage workers instead, our GDP would have grown by about $32.3 billion, over triple the $10.4 billion boost expected from the Wall Street bonuses.

Yeah, you read that right. In 2013, by giving huge bonuses to those on Wall Street instead of low-wage workers, we actively prevented the creation of about $22 billion in additional national wealth. In 2014, we did the same thing, but to an even larger degree, preventing about $23 billion in additional national wealththat would have otherwise been created, had those billions in bonuses been distributed to low-income earners instead.

Year after year, we prevent new wealth creation. Why is this the case? What causes such a big difference in wealth creation, such that money at the bottom is overthree times more effective at driving economic growth than money at the top?

Well, economists call it the "multiplier effect" whose origins are in what's called the "marginal propensity to consume." It describes how those with little money spend it quickly and those with lots of money don't.

Fast Money vs. Slow Money

Simply put, monetary exchanges have a frequency rate -- a "velocity" -- and this rate is far higher at the bottom than at the top. When you have a lot of money, each individual dollar, for the most part, just kind of sits around. Sure, it may be put to use eventually, but these dollars are more like gold coins inside Scrooge McDuck's bank vault. Occasionally they get swam in, but they're really just there to be counted and look shiny. Additionally, they can even get sent overseas to sit around in vaults elsewhere.

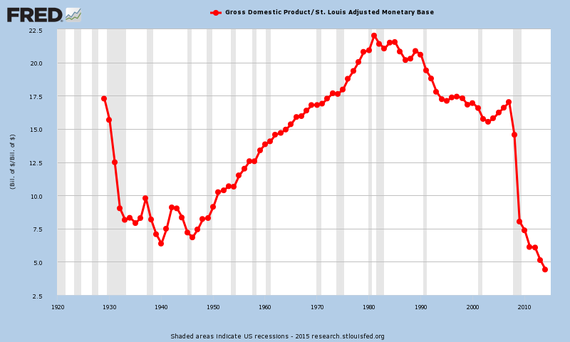

Looking at the latest money velocity charts and comparing today's numbers to the historical record is all one needs to see what happens to the overall rate of market exchanges when we start letting the top accumulate more and more of the total money supply.

We are exchanging the dollars in our money supply more slowly than even during theGreat Depression. The result has been an economy growing more and more tilted every day, such that even Disney itself, a company built on middle class consumption,is actively leaving it behind in an accelerating sprint towards that shrinking population with money to spend in greater and greater amounts.

The velocity of each dollar in our total money supply is now lower than has ever been recorded in all of U.S. history.

Meanwhile, that shrinking amount of money that's still accessible in hands at the bottom? It's changing hand after hand, and quickly. That dollar is no coin in a bank vault. It helps buy a gallon of milk, which pays a cashier, which helps buy a haircut, which pays a hair stylist, which helps buy a ticket to a movie, which pays a concession stand worker, which helps buy a dinner for two, and on and on it goes, like a fiery hot lava potato.

Section 2: Subtraction and Addition

It's not just that someone with little money has enough money to spend that expands an economy. The most effectual part is that a dollar is also removed from the hand overflowing with dollars. Who knew Robin Hood oversaw such an effective economic stimulus program? But that's how it works and also in a way that stabilizes the entire economy according to a new model built by Ricardo Reis and Alistair McKay of Columbia University and Boston University.

"It's the redistribution that has a lot of kick," Reis said in an interview with Bloomberg. "The usual argument for transfers is basically Keynesian. We find that has very low impact in our model."

According to Reis and McKay, there is no better way of creating a more stable economy than to expand tax-and-transfer programs that specifically reduce inequality, like food stamps and social insurance.

A healthy economy is not one of extreme inequality, but one where everyone has enough money to spend into it, to the point they can start saving what they don't need to spend.

When the only ones capable of making exchanges are a small percentage of the population, the entire economy suffers because the many are excluded for the benefit of the few, but this benefit too is an illusion. There is no real benefit. Pretending otherwise is like thinking that cutting off the blood in your body to everything except the brain is good for business. It's not. It's good for gangrene.

OECD Findings

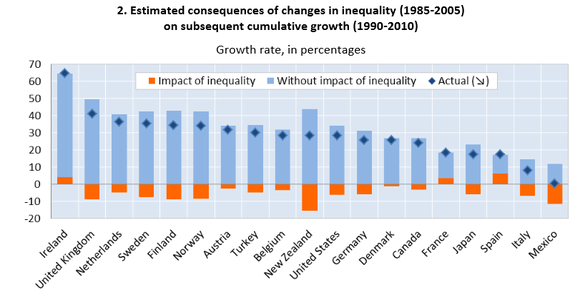

In a December 2014 report titled, "Trends in Income Inequality and its Impact on Economic Growth," the OECD found that inequality slows economic growth.

"Rising inequality is estimated to have knocked more than 10 percentage points off growth in Mexico and New Zealand over the past two decades up to the Great Recession. In Italy, the United Kingdom and the United States, the cumulative growth rate would have been six to nine percentage points higher had income disparities not widened, but also in Sweden, Finland and Norway, although from low levels. On the other hand, greater equality helped increase GDP per capita in Spain, France and Ireland prior to the crisis.

One sentence from the report stands out in particular, as something absolutely vital to focus on to achieve strong economic growth.

It is not enough to tax and transfer only from the top to the bottom.

Transfer recipients must include at least about half of the entire population. The incomes of the middle class must be increased alongside those living under or near the poverty line, and all of this entirely at the expense of the top. By not doing this, we all lose, even the rich.

Between 1990 and today, US GDP grew from $6 trillion to what is now almost $18 trillion. The OECD is saying that had we not allowed our inequality to grow alongside it, our GDP would have grown an extra trillion dollars. And had we reduced our inequality, our GDP would now likely be somewhere north of $20 trillion instead of $17.7 trillion.

But we didn't do that. We instead shoveled money hand over fist into the pockets of those with already overstuffed pockets, and to this day we continue to do so. However, this behavior is beginning to be questioned by even more growth experts than the OECD. The IMF is now asking them too.

IMF Findings

In June of 2015, the International Monetary Fund upped the ante with an even more damning report on the effects of income inequality on economic growth than the OECD.

According to the IMF, increasing the share of the total pie of the top 20% by just 1% (by, say, throwing bonuses at them) decreases economic growth by 0.08 points. It actually damages the economy. Overall wealth decreases. On the other hand, increasing the share of the bottom 20% by the same 1%, increases economic growth by 0.38 points, that makes it five times more effective and in the direction we actually want. Similar growth increases are seen in decreasing amounts for the middle three quintiles, with 0.33 points, 0.27 points and 0.06 points respectively.

In other words, transferring money from the bottom to the top actually slows GDP. It erases national wealth. It shrinks the pie. Whereas doing the opposite -- transferring money from the top to the bottom -- is the equivalent of throwing Viagra at GDP. It quickly grows the pie. When the bottom 60% get a larger share, everyone greatly benefits, including the top 40%.

The OECD data points to redistributing from the top to the bottom 40%.

The IMF data points to redistributing from the top to the bottom 60%.

No data points to redistributing to the top from the bottom, which is -- unfortunately for everyone -- exactly what we've been doing for decades. Redistribution actively already exists, and it's in the wrong direction for GDP growth.

The United States: Taking from the working poor and middle classes to give to the rich for 40 years.

So this idea that we should ever let inequality increase because it grows the total pie is completely and utterly false. By letting inequality increase, the entire pie actually shrinks. If we want the pie to grow we need to shift some of that stagnant wealth of the top 20% over to the other quintiles, and the more we shift towards the bottom and middle, the faster the pie will grow for everyone.

This is a huge reason, if not the best reason, for everyone to support the idea ofuniversal basic income: increased economic growth that benefits everyone. By reducing the rate of wealth accumulation of the top 20% in a way that better distributes that income to everyone else, we see the potential to build national wealth at historic new rates.

A Big Economy

I've estimated before that the total additional cost required to give every adult citizen a basic income guarantee (BIG) of $1,000 per month and every citizen under eighteen $300 per month would be around $1.5 trillion after the elimination of expenses no longer required with a basic income. This is roughly 8.5% of GDP. (Note: the total cost of child poverty alone is 5.7% of GDP)

If that revenue is removed from the vaults of the top 20% where it is sitting stagnant and distributed to the bottom 60% (no need to alter the distribution for the 60-80% according to the OECD or IMF), that's about a 2.83% increase for each quintile combined with the growth from the 8.5% decrease in the 5th quintile. If these are then multiplied by the IMF numbers per 1% increase, the total combined result is a 3.45% growth estimate, for a new total GDP growth rate of potentially 6.44% with a universal basic income in place.

This may sound high, and admittedly quite wonkish, but I believe it's also likely we'll see second and third order effects along the lines of increased productivity, and wage increases through higher bargaining power, which would both result in potentially even larger increases to GDP growth with basic income than the IMF or OECD data points to.

This may sound high, and admittedly quite wonkish, but I believe it's also likely we'll see second and third order effects along the lines of increased productivity, and wage increases through higher bargaining power, which would both result in potentially even larger increases to GDP growth with basic income than the IMF or OECD data points to.

7. Pay Attention Down-Ballot

The Left's Green Lantern Problem

Electing a president will never be enough. To truly change America, progressives must start winning down-ballot races—and soon.

by Suzy Khimm, newrepublic.com, November 20, 2015

The story of the post-Obama Left began just a few years into his presidency, with the rise of Occupy Wall Street. The 2011 protest movement injected catchy memes like “the 99%” into popular consciousness, and it kickstarted the debate about inequality that’s now at the heart of the 2016 election. But Occupy’s work remained incomplete, partly because its activists never united behind a clear political strategy, and never teamed with others on the left to turn their vision into reality. “We were defeated because we couldn’t learn to work together,” says Winnie Wong, a NYC-based Occupy activist.

Wong is among the Occupy alums who have now shifted gears: She’s working with more than a dozen of her former comrades from Zuccotti Park to support Bernie Sanders’s insurgent presidential campaign. Well before Sanders mobilized his own volunteers, Wong helped set up People for Bernie, a digitally driven grassroots campaign to support his presidential bid. People for Bernie is credited with starting the #feelthebern hashtag that’s helped mobilize Sanders’s online ground troops. It’s even received funding from the National Nurses Union—one of only two labor unions that has endorsed Sanders—to hire staff and make digital media buys.

There’s a certain irony here: Veterans of a movement hellbent on being bottom-up and leaderless, now working to elect the leader of the free world as their first big foray into electoral politics. But in many ways, it’s a logical extension of the left’s lopsided organizing model: American progressives have long focused their energies and resources disproportionately on presidential contests.

For a bottom-up movement, this top-down approach has been one of the fundamental contradictions of the Obama era. An unprecedented grassroots campaign powered the first black president into office, and pressured him to pursue an unabashedly progressive agenda on issues like health care, gay rights, and immigration. At the same time, the 21st-century coalition behind his two victories proved impotent in midterm elections. That allowed Republicans—hardcore conservatives, in most cases—to take control of Congress and more statehouses than any time in recent memory.

Now Sanders, like Obama, is providing another unexpectedly strong challenge to a Democratic frontrunner (the same one, in fact). And again, it’s thanks to a dedicated army of true believers. Progressives are also succeeding in nudging Hillary Clinton, the Democratic frontrunner, to the left on a host of issues. But so far there’s little evidence that progressive enthusiasm is trickling down to where it’s most desperately needed. With Congress in perpetual gridlock, national politics and policy are increasingly hashed out at the state level. So while the left’s agenda keeps growing more more ambitious, its ability to enact that agenda is diminishing.

The 2016 presidential election has coincided with a rebirth of the progressive movement, in causes like Fight for $15, Black Lives Matter, and a restive wave of campus activism. While some of these activists are now more willing to delve into electoral politics, their focus remains largely on the White House, whether it’s joining up with Bernie or pressuring Clinton. And they aren’t alone: Lefty donors have joined the activists in largely zeroing in on federal elections—allowing Republicans to invest their way into winning congressional and state races, even in many of the same states that Obama won.

To see the limits of this approach, consider what a Sanders presidency—even one fully dedicated to each and every one of these platforms—would look like, in the likely event that Republicans keep Congress and control of most states. Sanders may have succeeded in dragging Democrats to the left on issues like tax reform, expanding Social Security, and getting money out of politics, but how would he actually turn his dream agenda into law? CBS’s John Dickerson pressed him on the question during the second debate, pointing out the scale of Democratic losses across the country. Sanders replied that his candidacy will spark “a political revolution, which brings working people, young people, senior citizens, minorities together.”

In other words, Sanders’s basic argument is: Elect me, and it will happen. There was a moment where that same dream of a post-partisan progressive coalition looked like it might work. That was 2008, when Obama’s victory also helped his party sweep Congress. But in retrospect, those majorities were hugely inflated by President George W. Bush’s collapse and disappeared as soon as the GOP cut his anchor. Since 2008, the party has lost 13 Senate seats, 69 House seats, and 12 governorships. It now controls only 30 out of 99 state legislative chambers. The depth of the losses mean that even a winning Democratic presidential candidate with long coattails can’t count on flipping Congress back to Democratic control. Democrats’ down-ballot losses also undermine the party’s future prospects, as the statehouses have long served as a pipeline for national political talent.

Electing a new Democrat to the White House in 2017 won’t likely mean big policy changes, but rather holding the line against Republican attacks and pushing far more incremental reforms through execution action. That is essential, of course, and the threat of unified Republican governance is reason enough for progressives to invest deeply in electing a Democrat to the White House. But the only way to achieve anything approximating the kind of change that the rising left wants to see—or Hillary, for that matter—is by wresting back control of Congress and the states. To believe otherwise essentially relies on the Green Lantern Theory of the Presidency. This, as political scientist Brendan Nyhan defined it to Vox, is the idea “that the president can achieve any political or policy objective if only he tries hard enough or uses the right tactics.”

The Green Lantern critique has sprung up around Donald Trump and his ham-fisted vision of the presidency. Unlike Trump, of course, Sanders is a true economic populist. But his fan base also runs the risk of viewing the presidency as a cure-all, and a President Sanders would face even bigger political constraints from a GOP-controlled Congress than President Trump.

The real road to progressive victory doesn’t run through the White House in 2016, but the states in 2020. Those races will decide who controls the next round of redistricting—and whether Republicans can largely lock down majorities in state capitals and Washington for another decade, as they did after their sweeping wins in 2010. “In Congress, the Tea Party lunatics have taken over the asylum,” says Dan Cantor, national director of the Working Families Party. “It’s state legislatures where progressives need to win back power.”

President Obama’s groundbreaking 2008 victory was powered by grassroots enthusiasm, but it didn’t pave the way for his party to follow. The Obama campaign capitalized on his ground-level support through an organization that was notoriously hierarchical and centralized; it enlisted state and local parties, but the campaign was in charge. This proved to be an effective strategy for winning the White House—but not much else. After Obama took the helm of the Democratic Party, the party also abandoned Howard Dean’s 50-state strategy to bolster state parties and put field operatives on the ground everywhere.

Now Democrats are catching up to their mistake. Clinton has vowed to re-invigorate the state parties, and her campaign appearances at fundraising events have helped them fill their coffers. After a long delay, the Democratic National Committee finallyreleased its plan for beefing up its support for both state and local party-building in advance of the 2020 redistricting. The Democracy Alliance, a network of rich liberal donors with close ties to labor unions, has also launched a project called “2020 vision” to invest in state-level electoral and policy fights by pouring money into outside groups.

It may be tough, though, to bring along progressive activists who see the political establishment as part of the problem. If Clinton is the Democratic nominee, many Bernie supporters are likely to hold their noses and vote for her. But convincing them to turn out in 2018 to support less prominent down-ballot candidates for the party’s sake may be far more of a stretch, particularly in the off-cycle elections where young and minority voters who are part of the Obama coalition are historically less likely to turn out. And if Democrats don’t make inroads in 2018, the 2020 Plan will take a miracle.

Conservatives have traditionally had an easier time rallying the GOP base at the local and state level—an advantage that’s only grown with the nationwide decline of organized labor. Though Tea Party conservatives are even more antagonistic toward their own party establishment, they’ve embraced down-ballot elections as a counterweight to centralized power in Washington—and, over the last seven years, as a way to strike back at Obama. And GOP power outside Washington has translated into huge setbacks for abortion access, along with new voter restrictions and the passage of right-to-work laws.

In more limited ways, a polarized Washington has also prompted progressives to take action on the state and local level, with initiatives to raise the minimum wage, shield immigrants from deportation, strengthen gun-control laws, and pass police body-camera laws. But most of the left’s activity in the states concentrates on on single-issue fights rather than candidates. And winning on those issues hasn’t always helped Democrats: In 2014, for instance, Nebraska, Arkansas, South Dakota, and Alaska all passed minimum wage increases through ballot initiatives backed by progressive donors and groups. But that wasn’t enough for Democrats to prevail in any of the contested Senate or gubernatorial races in those states, or shift the statehouse majorities.

The national agenda that’s helped revive the left doesn’t always translate to wins for state and local candidates. Michael Bloomberg’s Everytown for Gun Safety pumped millions into TV ads to help flip the Virginia Senate to Democrats in October, but Republicans prevailed in part by seizing on a controversial proposal to raise tolls on the I-66—the kind of bread-and butter issue that tends to dominate down-ballot races. When Democrats do get elected on the state level, they often find themselves in the political wilderness, says Nick Rathod, executive director of the State Innovation Exchange, a newly formed (and Democracy Alliance-funded) progressive policy hub. “They feel they’re on an island, they’re not connected to each other, they feel abandoned by the party and national leaders, and they don’t have a central place to go for ideas.”

The left is trying to find—and fund—new ways to sustain grassroots enthusiasm and connect activists to local causes. The Democracy Alliance is flirting with funding groups affiliated with Black Lives Matter, and it’s already backing efforts like the National People’s Alliance, which supports local candidates in Chicago, and the Working Families Party, which helped NYC Mayor Bill DeBlasio prevail in 2013. There’s even a new Black Lives Matter SuperPAC that plans to “endorse candidates in local races across the country,” according to The New York Times. And like many Sanders activists, Winnie Wong insists that the Bernie movement isn’t just about the 2016 election, but about building something bigger that will continue well after the race is over. “This,” she promises, “is the beginning of a story that will continue to scale over the years.”

It’s easy to understand the temptation for progressive activists to go national. But in leapfrogging from the grassroots to the national stage, they also risk bypassing the political work that needs to happen—has to happen—for their demands to be met and their dreams to be realized.

FINALLY

No comments:

Post a Comment